Harvey, FileVine, EvenUP, Family Office Investment and new 1B Valuation

GUEST POST by Edward Bukstel [of GenAI Tool - Giupedi]

[Ed has a very impressive tool in Giupedi.com which uses GenAI to match attorneys to clients. He very kindly gave permission to re-post his great and detailed article here on AI Counsel News.]

Why would a Legal Technology AI Company “LowKey” a $35 Million Investment? UPDATE: It’s Now in Talks for $1 Billion Valuation.

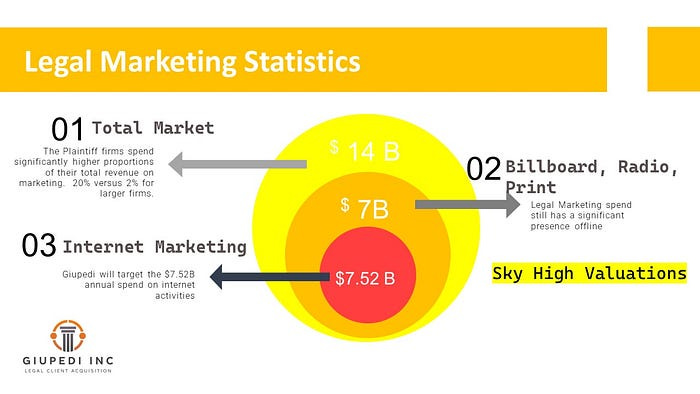

There’s been a lot of activity in the Plaintiff Lawyer market over the past month or so. On September 5, 2024 Anytime AI announced a $4m Investment in their product that focuses on Personal Injury Attorney’s. The company’s Press Release had all of the usual GenAI stuff that we are used to seeing these days. A couple of things piqued my attention, specifically this seems to be the first investment that I’ve seen by a Family Office directly into a Legal Technology startup. The interest of a Family Office in Anytime AI may have been more focused on the fact that they were in the AI/ML segment, then specifically because of the focus on Legal, based on a PwC Report.

Family Offices have caught a lot of attention over the last month or so, with CNBC Reporting Family offices are about to surpass hedge funds, with $5.4 trillion in assets by 2030. There are currently over 8,000 Family Offices worth over $100m or more. The Family Office that invested in Anytime AI is identified as the Kao Family Office which appears to be run by Michael Kao. (aka: Kaos Theory, UrbanKaoBoy) The investment is not listed on any website of the Family Office or Michael Kao’s LinkedIn Page, which highlights the historically secretive nature of Family Offices.

Family offices are increasingly notable in venture capital. According to a 2023 PwC report, family office-backed deals accounted for a significant portion of startup investments globally in 2022. These entities, historically more discreet in investment circles, are now aligning their investment strategies with key venture capital verticals like FinTech, AI, and SaaS. Their involvement as limited partners in funds underscores their growing interest in the high-growth potential of startups. (Nasdaq, Feb 2024)

In addition to the Family Office, Gopher Asset Management is identified as an investor, and like the Kao Family Office, there is no listing of the investment in Anytime AI on their website. This may be a “thing” moving forward, as we are seeing Family Offices participate in startups and venture funding in ways that we haven’t before.

As I read through the website information on Anytime AI and reviewed the Press Release, I couldn’t help but think about my all time favorite Legal Tech funding, EvenUp Law.

Distinguishing itself from competitors, Anytime AI is building a trustworthy and powerful AI legal assistant along with various AI agents specifically designed for plaintiff lawyers. Our unique solution leverages Large Language Models (LLMs) as a Legal Reasoning Engine and integrates them with Legal Workflow Customization and other advanced technologies such as Retrieval-Augmented Generation (RAG), Information Extraction (IE), and Optical Character Recognition (OCR). We address AI risks, including ‘’AI hallucinations’’ and inaccurate results, guiding lawyers to validate AI outputs easily and thoroughly while maintaining client confidentiality and data security. AnytimeAI™ empowers lawyers to perform their daily core legal work activities much more efficiently and effectively, ranging from legal research to document review, and from medical record analysis to demand letter generation, all in minutes instead of hours or days.

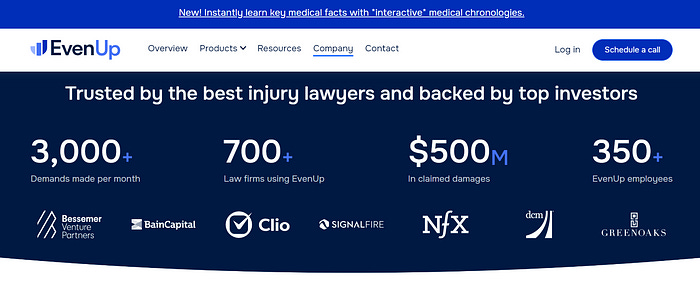

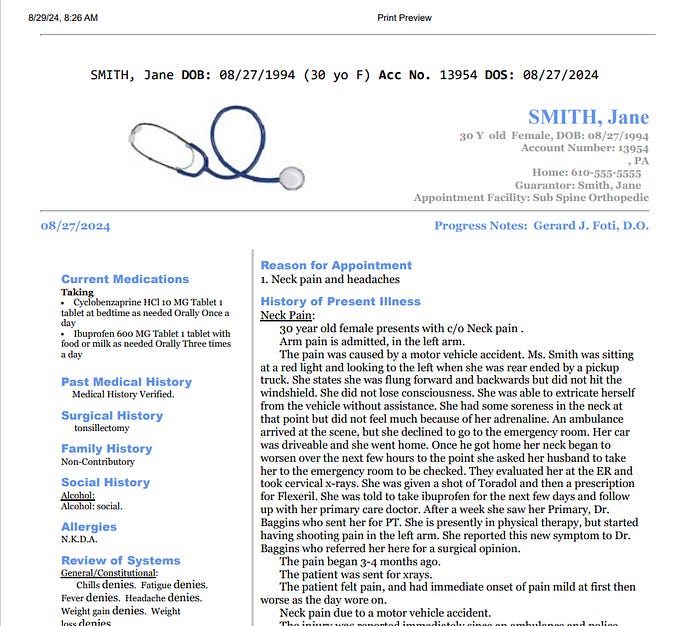

Like Anytime AI, EvenUp focuses on the Plaintiff Attorney market and had it’s coming out party in June 2023 with an eye-popping $50m investment at a valuation of $325 million. The investor pedigree was also notable with Bain Capital, NFX, Bessemer Venture Partners, and SignalFire. My business partner, Orthopedic Spine Surgeon, Dr. Gerard Foti had introduced me to the world of Plaintiff Law and the challenges faced by physicians treating patients/clients. So, we started a business called Giupedi back in 2019 to address the inefficiencies, and I’ve been hooked on the nexus of law and medicine ever since.

Obviously, the GenAI functionality of document reading and ingestion was not available back in the day, so we were forced to use Optical Character Technologies and Text Extraction APIs like Amazon’s Textract. It goes without saying, times have changed, and the text extraction functions and costs are much different for products like EvenUp and Anytime AI. Back in the day, only a couple of years ago, OCR and Extraction via Amazon’s API cost upwards of $65 per 1000/pgs.

EvenUp’s strategy began with the extraction of medical billing, documentation, and medical record information that was combined with an algorithm that was “trained” on 250,000 settlements and verdicts. The result is a comprehensive “Demand Letter” delivered in a week. In addition to the Demand Letter, EvenUp will also flag missing medical bills and documentation.

I decided to compare what Anytime AI was doing with Demand Letter’s and Medical Documentation so I went to the EvenUp website and found something astonishing. EvenUp raised another $35m that wasn’t covered in the Legal Tech Media, and there wasn’t any type of Press Release.

There’s a glowing puff piece of an article in Forbes This Startup Uses AI To Save Lawyers Time — And Help Plaintiffs Get Higher Settlements talking about the $35m investment from Lightspeed Venture Partners.

Somebody has a really good contact over at Forbes. EvenUp has appeared a few times in the magazine with glowing reports about its business prospects and future.

The startup isn’t the only one pitching itself to law firms as the AI-powered solution to their problems or inefficiencies. AI 50 startup Harvey, an alum of last year’s Next Billion-Dollar Startups List, recently achieved unicorn status with a $100 million Series C funding round led by Google parent company Alphabet Inc.’s investment arm. AI assistant Clio, which debuted on the Forbes Cloud 100 list last week at 56 and participated in EvenUp’s Series B round, recently closed a monster $900 million Series F at a $3 billion valuation.

The Company has appeared alongside Harvey AI as the next Billion Dollar Startup on $12m estimated revenues. There is no question that they have grown significantly since the June 2023 funding round. They have added more law firms, approaching 1000, according to the August 14, 2024 Forbes article.

My daughters tell me something is “Sus” when I tell them about the old days about having dials on rotary phones or there was a wire that connected a phone to the wall. When I first looked at the $35m investment that essentially went deliberately under the radar, I was thinking something was “Sus.” My first thought was “maybe it was a down round and they didn’t want to advertise, the raise, or the valuation.”

Suddenly, as part of another Google Search a freaking crazy article popped up in my Search Results….

Bain Capital Ventures and EvenUp at $1,000,000,000 Valuation

According to The Information, the lowkey $35m funding on August 13, 2024 was at a valuation of $500m, and the company is in talks with Bain Capital for a raise at a $1 Billion Valuation. It’s no secret that Bain Captial Ventures loves the EvenUp story. Two of their Partners in Applications and Artificial Intelligence, Sarah Hinkfuss and Aaref Hilaly, have spoken glowingly of EvenUp.

Like many close relationships, our partnership with EvenUp developed over time. We first met Rami Karabibar in a drafty coffee shop in San Francisco in December 2019, when the company was just a few months old. Over the next few years, we kept in touch for several reasons. Sarah had grown up watching her father, an attorney, spend considerable personal time on pro bono cases fighting for legal justice. Aaref had successfully built a legal e-discovery business, Clearwell, before becoming an investor. Both intuitively understood the unintentional unfairness of the legal system, where individuals often face overwhelming odds when making claims against powerful groups like large corporations.

We’ve seen a lot of companies out there in Legal Tech that proclaim productivity increases at law firms = Access to Justice. While I have my doubts in certain instances, like Harvey’s claims to help folks in Singapore, we do have a shortage of attorneys. Therefore, productivity increases in Personal Injury Cases may indeed help folks get the justice they deserve. Clio participated in the June 2023 funding as well and they were also interested in the Access to Justice angle.

“Our goal in launching Clio Ventures is to identify and support companies who are developing innovative technology that aligns with Clio’s mission of improving the legal process and increasing access to justice for all,” said Shubham Datta, Vice President of Corporate Development at Clio. “EvenUp’s mission to close the justice gap for personal injury victims through technology is incredibly innovative. We’re excited to welcome EvenUp to our ecosystem and offer Clio customers access to its game-changing technology to ensure all lawyers and victims have equitable access to justice.”

Before we get all crazy about the $1 Billion Valuation for EvenUp, we should consider the source. It’s The Information, which broke the story about Harvey’s $2 Billion Valuation and a pending acquisition of vLex, remember that one!

The reporter on the Harvey $2 Billion Valuation and the EvenUp $1 Billion Valuation story are the same, Stephanie Palazzolo. The June 7, 2024 story about Harvey acquiring vLex caught fire, and turned out to be a nothing-burger. There seemed to be a ton of details, including valuing vLex at $600m in a cash deal with new money being raised from investors. Getting back to the $35m Lightspeed Ventures Investment, it was really lowkey as stated above, even Rami Karabibar’s LinkedIn page had nada, zilch, nothing about it. There is literally a gap between last years $50.5m raise up to the recent article in Forbes talking about the potential $1 Billion Valuation.

What does this all mean? In Legal Technology, we’ve seen a lot of activity from a GenAI perspective of tools that specifically help lawyers write motions, opinions, complaints, and other legal documents based on the deployment of legal focused LLMs. There is a huge amount of activity occurring on the Plaintiff Law side that may or may not have cross-over into the stuff that Big Law does on a day to day basis.

For instance, the intersection of Legal and Medicine happens in the Plaintiff side of the equation for, Personal Injury, Medical Malpractice, Workers Compensation, and Mass Tort litigation. There is an extra requirement of knowledge and expertise in medical terminology and workflows in these domains.

This space is getting a lot more attention at the high end and the lower end of the pricing spectrum. What is the difference between a $97 Demand Letter versus the AI functionality of an EvenUp or Anytime AI? There’s approximately 164k Personal Injury Lawyers in the US spread across 60k Law Firms. The only other threat to EvenUp business is a potential change in the linkage of Demand Letters with Personal Injury Firms. It is very possible that some Alternative Legal Service Provider could provide the Demand Letter side at a significant discount, which could cause shockwaves in the entire business model of PI firms. But, then again, if EvenUp has 1000 Law Firms signed up, there’s a lot more of growing to do, which could account for a potential high valuation.

EvenUp has added functionality to their flagship demand product by providing an additional view into the medical documents that have been processed. This is similar to the work the my business partner and I did, although our goal was to produce a Medical Index that compiled all of the information into a record that could be presented as evidence, including the chain of custody references to the original documents. This takes up a ton of storage space, and we don’t recommend you use the Blob File Services on Azure, unless you have also built an easy way to grab the original document.

Clio, Litify, Filevine, Cloudlex, Gladiate, Humata Ai, Lexamica, CasePeer Firm Pilot and many more are involved in the Plaintiff side of Legal Technology. Once again, in order to make these systems work there’s a need to have some form of interoperability with the healthcare system.

Filevine recently announced a partnership with Arctrieval to help streamline the retrieval of medical records from hospital settings. It’s actually a cool little service that allows you to costly medical records at a fixed monthly price, if you can wait up to 30 days. At Giupedi, we’ve built a system that integrates with an API that can provide access to healthcare claims within 30 seconds.

This went way longer than I expected, so I’m gonna leave the Harvey situation link from Artificial Lawyer below, and deal with the Legal Marketing Side of Plaintiff Law in another post.

Harvey disappoints from Artificial Lawyer

find Ed at ebukstel@giupedi.com. 267.690.3116 giupedi.com article link