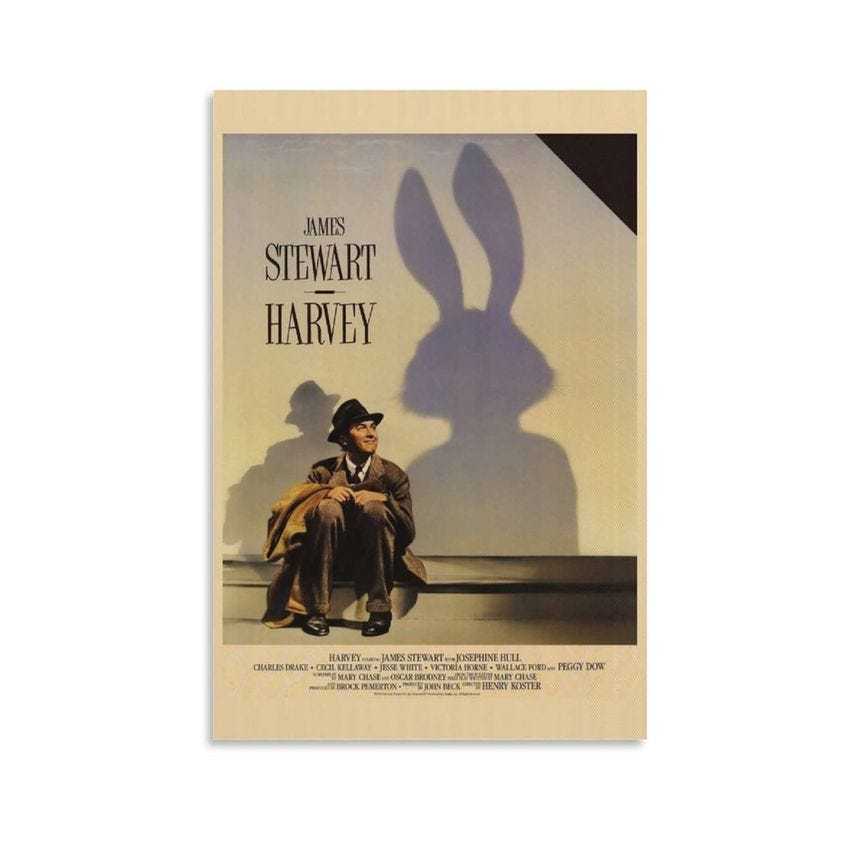

“Oh, yes! Yes. Yes — these things always work out just the way Harvey says they will. He is very, very versatile. Did I tell you he could stop clocks? Well, you've heard the expression 'His face would stop a clock'? Well, Harvey can look at your clock and stop it. And you can go anywhere you like — with anyone you like — and stay as long as you like. And when you get back, not one minute will have ticked by. ... You see, science has overcome time and space. Well, Harvey has overcome not only time and space — but any objections.” - Harvey the Movie, 1950

Harvey, the 800lbs AI for Law Gorilla, is receiving forceful and seemingly insightful questions queries and rumors about its valuation, performance, and revenue. At least on REDDIT (READ HERE), which itself is admittedly notoriously meaningfully shaky and uneven. And yet.

Says the original poster:

“It all sounds great on paper, but it raises more questions than it answers:

Is anyone actually paying serious money for this?

Are these real enterprise deployments or glorified pilots?

How much of this is just designed to inflate ARR ahead of the next raise? And what's the money raised so far going towards? Acquisitions?

Is Harvey "lagging" for a company with so much capital? Why aren't they moving more quickly? Or acquiring more?

Feels like there’s a big gap between the marketing and the actual commercial reality.”

And the debate and additional adds and observations come…

NO OTHER NEW AI FOR LAW COMPANY COMES CLOSE TO HARVEY IN FUNDING

Summary of Harvey’s Funding Rounds (2022–2025)Harvey, a legal AI platform founded in 2022, has raised $506M across five funding rounds:

Seed Round (Nov 23, 2022): $5M, led by OpenAI Startup Fund.

Series A (Apr 26, 2023): $21M, led by Sequoia Capital.

Series B (Dec 18, 2023): $80M, co-led by Elad Gil and Kleiner Perkins, with OpenAI Startup Fund and Sequoia Capital. Valued at $715M.

Series C (Jul 23, 2024): $100M, led by Google Ventures (GV), with OpenAI, Kleiner Perkins, Sequoia Capital, Elad Gil, and SV Angel. Valued at $1.5B.

Series D (Feb 11, 2025): $300M, led by Sequoia Capital, with Coatue, Kleiner Perkins, OpenAI Startup Fund, GV, Conviction, Elad Gil, and REV (RELX Group/LexisNexis). Valued at $3B.

Note: A reported Series E round of $300M in June 2025, co-led by Kleiner Perkins and Coatue at a $5B valuation, is mentioned in some sources but not consistently confirmed across all data

800 Million is a lot of clams to re-invent the Law for the first time in history.

Here is a list of all of Harvey’s Toppest Shelf Investors:

Sequoia Capital (led Series A, D, and E rounds)

Kleiner Perkins (co-led Series B, D, and E)

Coatue (co-led Series D and E)

Google Ventures (GV) (Series C and later)

OpenAI Startup Fund (Series A and later)

Elad Gil (angel investor, Series B and later)

Conviction (Series D and E)

REV (RELX Group/LexisNexis venture arm, Series D and E)

DST Global (Series E)

Elemental Ventures (early investor)

SV Angel (Series C and later)

Kris Fredrickson (angel investor, Series E)

And yet increasingly the market is questioning.

Harvey began as a “wrapper” (one of the biggest) on ChatGPT, yet appears to be expanding outward into other vendor (data, compute, storage?) relationships. Its operations notoriously opaque.

On June 12, 2025, it just updated its Subprocessors list — which had previously listed only OpenAI and Microsoft. Here is that disclosure:

As I have repeatedly written before, the ‘corpus cost’ (cost center, if you prefer) of any AI company is COMPUTE. The cost of compute ranges from 60% to 90% of an AI company’s operating cost.

So naturally a partnership with OAI would be key. Other would also be key.

Yet the risk with private companies and undisclosed agreements is that the market is left to wonder - what does their API pricing look like? If a compute provider (which is also an INVESTOR) could lower the compute cost, wouldn’t that result in a corresponding higher IRR (internal revenue number) and a corresponding enterprise VALUATION?

And how would we know? Should we know? Likely in time we will know.

The brand new element in the AI business of Compute cost and VC investment and company valuations and customer revenue recognition make room for mischief, is all that I am saying.

I may be picking threads. I have no inside source information. I’m not saying anything other than deductive because I have no else to say.

The company’s namesake is a movie, “Harvey” about a man (played by Jimmy Stewart) who imagines a giant invisible-to-others 6 foot bunny rabbit as a friend who helps him. When he ends up in a sanitarium he remains committed to his friend Harvey, and the reality of Harvey’s existence remains in the end ambiguous, but its impact on others transformative.

How much imagining in AI [+ Law] is ideal for users, investors, the market, and the industry?

For an early critical take touching on 2024 secrecy, see AI entrepreneur Edward Bukstel’s take here on Medium “There’s Definitely Something About Harvey.”